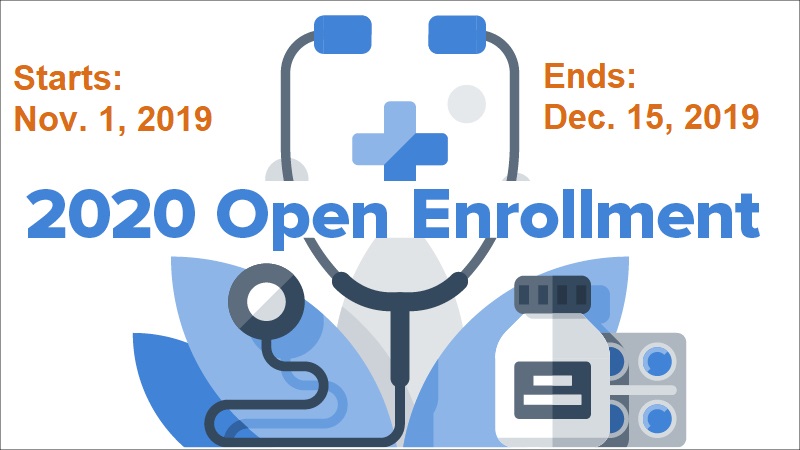

Your Guide to Medicare 2020-Open Enrollment.

It’s time for Medicare Fall Open Enrollment. Knowing how to navigate coverage options and understanding what changes are in store for Medicare in 2020 will help you make the most informed decisions during Fall Open Enrollment.

During this time, you can make changes to your prescription drug plan, enroll in a plan, change your Medicare Advantage Plan, or enroll in a Medicare Advantage Plan.

WHO IS ELIGIBLE FOR MEDICARE? People that are 65 or older or those that have been disabled and collecting social security disability for 24 months.

What to Expect in 2020

- Plan F will no longer be offered to newly eligible enrollees. If you have a Plan F currently, your plan will remain the same. If you became eligible for Medicare before January 1, 2020 you will still be able to enroll in Plan F.

- Humana had made a change to their prescription drug plan. Those on the Humana Walmart Plan have been re-mapped to the Humana Premier RX plan. Humana is offering a less expensive option, but we MUST make sure your drugs are covered in the new plan. If you want to discuss your options, please have your list of drugs available.

- The Part D (prescription drug) deductible has increased to $435. Many carriers offer plan with $0 deductible for drugs in Tier 1 or Tier 2.

- Donut Hole: The initial limit has increased to $4,020.

- United Healthcare/AARP and Blue Cross Blue Shield have little to no changes to their plans for 2020. If you are happy with your plan, the plan will automatically renew.

Tips to Reducing Your Medicare Premium

- Consider a Medicare Advantage Plan. If you are already in one, you may want to consider another carrier. Be sure to pick a plan with a maximum out of pocket and confirm that your doctors accept the plan before switching. This will protect you in the event of a “bad” year.

- Consider switching the type of Supplemental Plan you are in currently (i.e. Plan G is often less expensive than a Plan F). I will caution, changing your plan may require you to pay for services that you have not paid for in the past. For example, a Plan N will charge the $185 deductible and $20 co-pay for doctors’ visits.

- Review your drug lists with other carriers. Medicare.gov is a great source for reviewing rates with other carriers. Simply plug in your drug information, select your pharmacy, and review the different plans available (based on the drugs you are taking).

- Consider switching pharmacies. First, watch to make sure your pharmacy is still in the Preferred Network with your prescription drug plan. Second, find out what the different pharmacies charge for your drugs. You may see a difference that can save you some time in reaching the donut hole.

This is an extremely busy time for me. I suggest scheduling early as my schedule will fill up. Contact me at 708-444-0050 or kelly@kellyburkeinsurance.com.

Please include your availability (i.e. mornings, afternoons, or evenings) and the type of appointment you are requesting (face to face or conference call).