Open Enrollment 2020. Get Your Answers Here.

What to expect in 2020

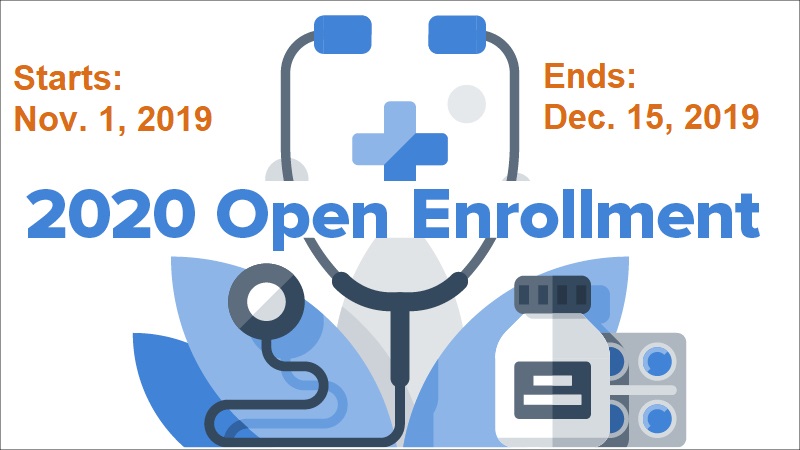

Open enrollment 2020 is right around the corner. That means it’s time to check in with me about your health insurance status. While we’re still in 2019, it helps to be proactive to get prepared, know the dates-and plan.

During this time, individual policy holders can enroll in a health plan or make changes to their existing plan. *If you obtain health insurance from your employer, you are likely to have a different Open Enrollment period.*

Whether you’re buying for an individual or a family, here’s everything you need to know about open enrollment 2020.

- The penalty has been removed! This means you will no longer receive a penalty for not having coverage or for obtaining a plan that does not meet the requirements of The Affordable Care Act (i.e. Short-Term Medical Plans).

-

Each carrier will continue to offer virtual visits. Policy holders can call or chat online with a nurse practitioner to obtain a diagnosis and prescription for medication. There is a small co-pay or $0 co-pay for this service (depending on the carrier and plan).

- Group plans are still an option for small employers. Blue Cross Blue Shield does offer relaxed guidelines during this time to allow for a 1-person group. The employer must have at least 2 full time employees that are not husband and wife. This includes 1099’d employees (NEW this year).

- As carriers continue to decrease or eliminate commissions to agents, I am forced to charge a fee for 2020. The fee will only be charged to Affordable Care Act Plans. This does NOT include Medicare or Short-Term Medical plans.

- Short Term Medical plans will NOT offer a 12-month plan period this year. The maximum policy period is 6 months. As a reminder, these plans to not provide coverage for pre-existing conditions, maternity, or wellness visits. However, these plans are a fraction of the cost of plans offered through the Marketplace and they all have a PPO network.

- Those that received a subsidy (aka assistance/reduced premium) are NOT obligated to update their income through the Marketplace. This will automatically renew based on income generated from your 2017 taxes.

- AND, The Good News. There will be little to no premium increase.

How to Avoid Rate Increases

- Be prepared to discuss your household, estimated adjusted gross income for 2020. This will be used to determine if you qualify for assistance.

- If you are going to opt to self-insure, protect yourself with a short-term medical plan or an accident/critical illness plan. The plan works separate from health insurance and pays you based on a diagnosis of a critical illness (cancer, heart attack, or stroke) and in the event of an accident (slip, fall, and break an ankle) the plan will pay you a certain dollar amount. The purpose is to use the funds to pay towards the unexpected hospital or urgent care visit.

- Review ALL of your insurance policies. I specialize in personal lines insurance, which includes auto, home and Medicare. As a broker, I have access to multiple carriers which allows me the opportunity to find the best plan based on your needs. I’ve saved people thousands by reviewing rates with multiple carriers.

This is an extremely busy time for me. I suggest scheduling early as my schedule will fill up. Contact me at 708-444-0050 or kelly@kellyburkeinsurance.com.

Please include your availability (i.e. mornings, afternoons, or evenings) and the type of appointment you are requesting (face to face or conference call).